Dear Valued Client,

Hope you and your loved ones had a joyous holiday season.

As we start another year, I want to take a moment to reflect on the journey we’ve embarked on together. The past year has been one of growth and positive progress in the financial markets, and I’m delighted to report that your investment portfolio has reaped the benefits of these favorable conditions.

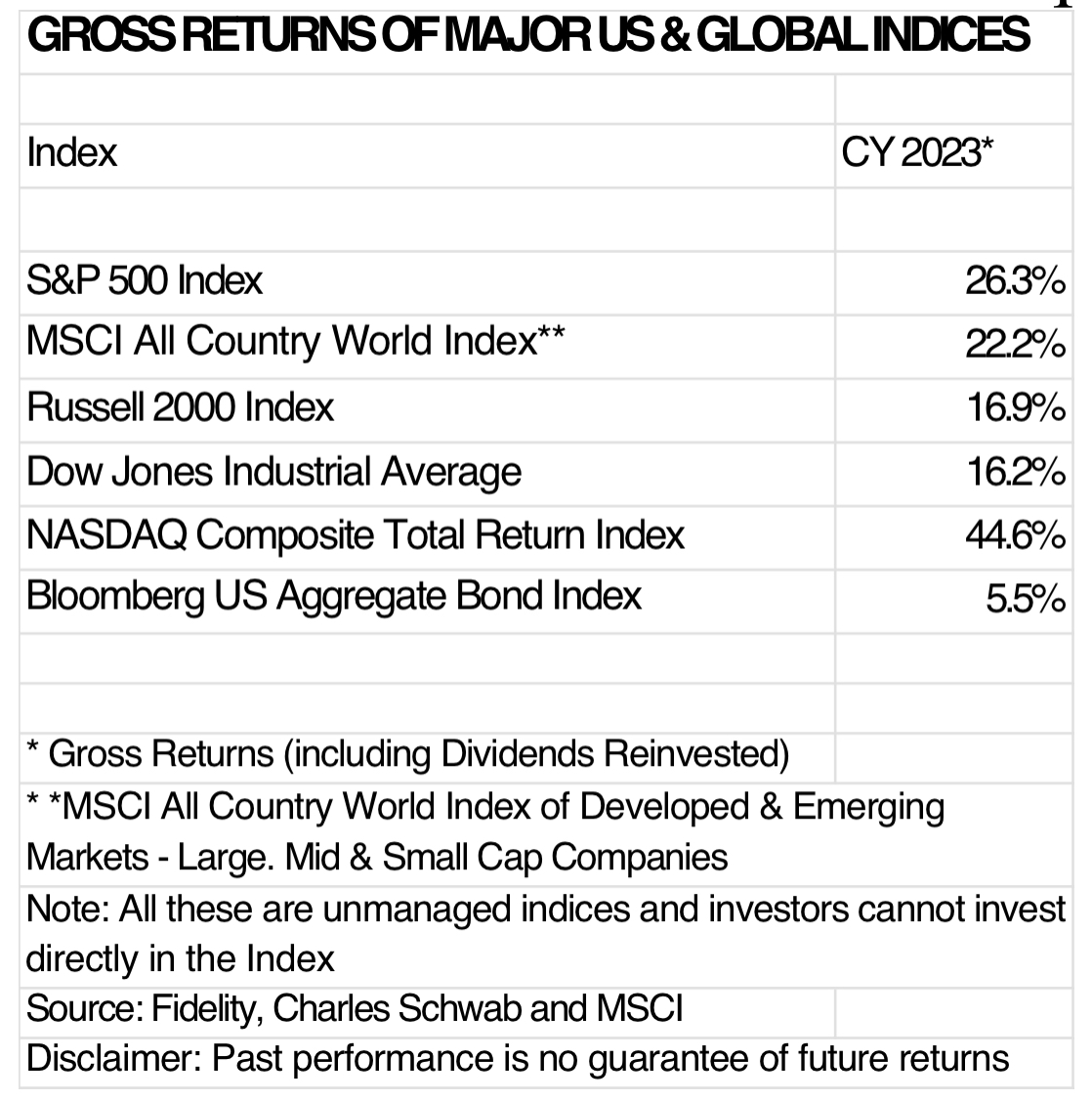

The various markets have been up for 2023 as follows:

Market Summary

- Early 2023 – As we started 2023, the Federal Reserve was intent on raising rates to curb decades-high inflation. After raising the Fed Funds rate by 4.25 percentage points in 2022, many people expected continued aggressive rate hikes throughout the year. However, the Fed tapered its increases to just 1 percentage point over the first five meetings of 2023 to reach a terminal rate of 5.25% by the July 2023 meeting. The markets showed tremendous resilience and strength in the early part of the 2023 rate cycle as rate increases slowed.

- Summer / Fall 2023 – Markets were somewhat weak over the August through October period. The 10-year US treasury rates crossed 5% in late October and market participants were worried about persistent inflation and general economic weakness due to high rates. “Higher rates for longer” was the fear at this time.

- Late 2023 – Inflation numbers for October started trickling in and were lower than expected, suggesting inflation was coming back to normalized levels. In addition, from the September 2023 meeting the Fed did not raise interest rates. As a result, November and December turned out to be robust months for the markets. And at the December meeting, the Fed signaled to the market participants that they were finally done raising rates this cycle and that the Board members have penciled in 3 rate cuts in 2024. The markets closed close to all-time highs at the end of the year.

The Federal Reserve’s rapid rate raising cycle and the Quantitative Tightening initiated by the Fed from March 2022 has curbed inflation without much economic weakness so far. The strong performance in the market this year reflected this reality and the fact that the Fed will likely not raise rates anymore. The December Fed communication echoed the repeated adage that I have been letting clients know – historically, the time difference between the last rate increase and the first Fed cut is typically 6 to 9 months.

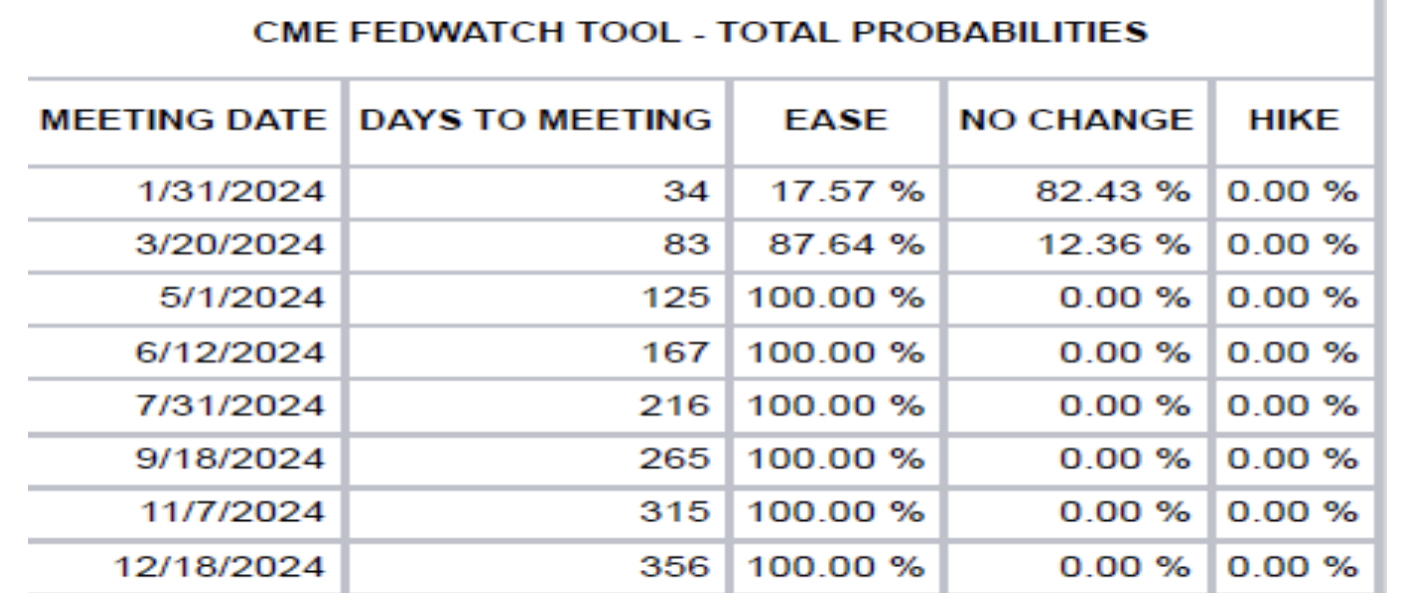

The Fed Funds futures are indicating that the first cut in rates is likely to be in the March 2024 meeting (9 months after the July 2023 rate increase) and that there could be 7 rate cuts in 2024 per the CME Fed Watch Tool.

Source: Chicago Mercantile Exchange as of December 27, 2023

These probabilities change frequently, and our contention is that the rate cuts are likely to be somewhere between 3 (per the Fed) and 7 (per the CME Tool).

Investment Performance

Your investments have mirrored the trends in the market and your portfolio has performed exceptionally well. This success is a testament to our collaborative approach and your trust in my guidance, for which I am deeply grateful.

We were positioned well for the Fed pivot and the taming of inflation as we held less cash and were heavily positioned in equities. Your portfolio performance broadly outpaced your respective benchmarks. We were able to take advantage of the strong performance in mega-cap stocks early in the year and mid-cap and small-cap stocks in the last two months. I believed at the beginning of the year that given the macroeconomic situation and valuations of top companies, we should remain generally fully invested (except where the clients have instructed us otherwise). That paid off in our portfolios this year.

2024 Outlook

Next year, inflation is expected to be relatively benign, and the Fed has room to cut rates somewhat aggressively, if needed. The Fed has also been shrinking its balance sheet through Quantitative Tightening since early 2022 and may consider a pause/taper/end to that tightening cycle over the next 18 to 24 months.

Today there are more global central banks that are cutting rates versus those that are raising rates – this is the first time this has happened since January of 2021. Clearly the Fed was too slow in arresting inflation, but it ended up working out in the end. The question moving forward is that will the Fed cut rates fast enough to prevent disinflation and slowing growth and jump starting the economy. Key data points to look out for include the Fed deciding whether to cut rates, inflation data, unemployment rate, GDP growth and jobs numbers. As usual, I will continue to update you as more data and indicators come out and help interpret what they mean.

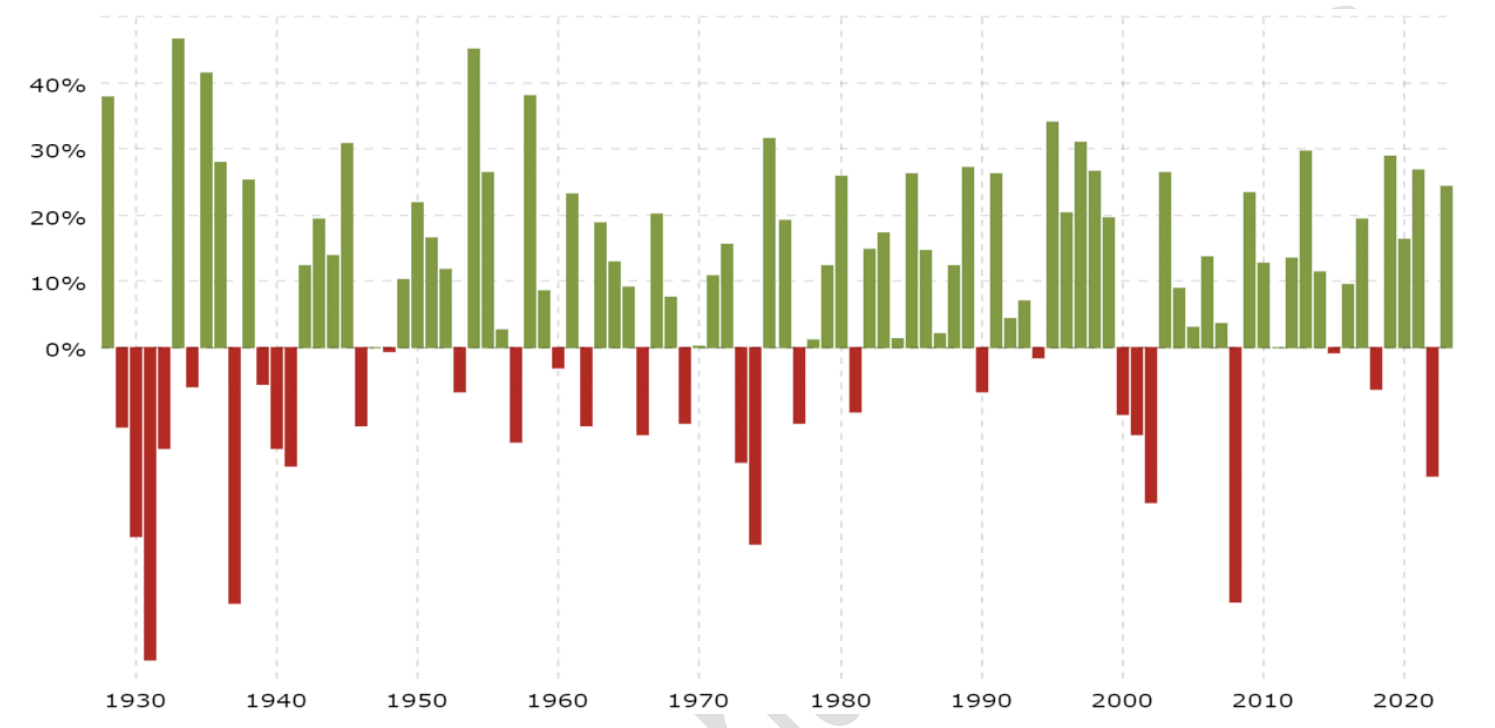

As can be seen from the upcoming chart, going back nearly 90+ years, markets have been up more times than they have been down.

Source: Macrotrends

Looking back further, in the last 40 years we have had three major negative periods followed by several years of positive returns. This just tells us that as the quality and speed of information and data has improved over the years, the investors have reacted more positively to the perceived certainty of data.

It’s important to recognize that market conditions are ever-changing, and while 2023 has been prosperous, we must remain diligent and adaptable. My commitment to you remains steadfast: to continue providing insightful, prudent advice tailored to your unique financial goals and circumstances.

Looking ahead, we’ll continue to monitor the markets closely, adjusting as necessary to ensure your portfolio is well positioned for whatever the future may hold. Your financial well-being is my top priority, and I’m excited to see what we can achieve together in the coming years.

Thank you for your continued trust and partnership. Wishing you and your loved ones a prosperous and healthy 2024.

Warm regards,

Sanjiv Jhaveri

SJ Capital Management LLC

January 6, 2024